Overview

We extended Venmo’s user experience to better support informal lending within tight-knit communities. Our goal was to reduce the friction that often comes with borrowing money and introduce a more structured lending process.

Process

Defining the Gap:

We broadly discussed potential user types, values, and existing products within the context of lending and borrowing among communities. We found ourselves consistently coming back to the user: how emotions like guilt impact decisions to borrow or lend, how the lender-borrower relationship impacts the loan dynamic, and what technologies would best serve the user’s needs in an informal lending situation.

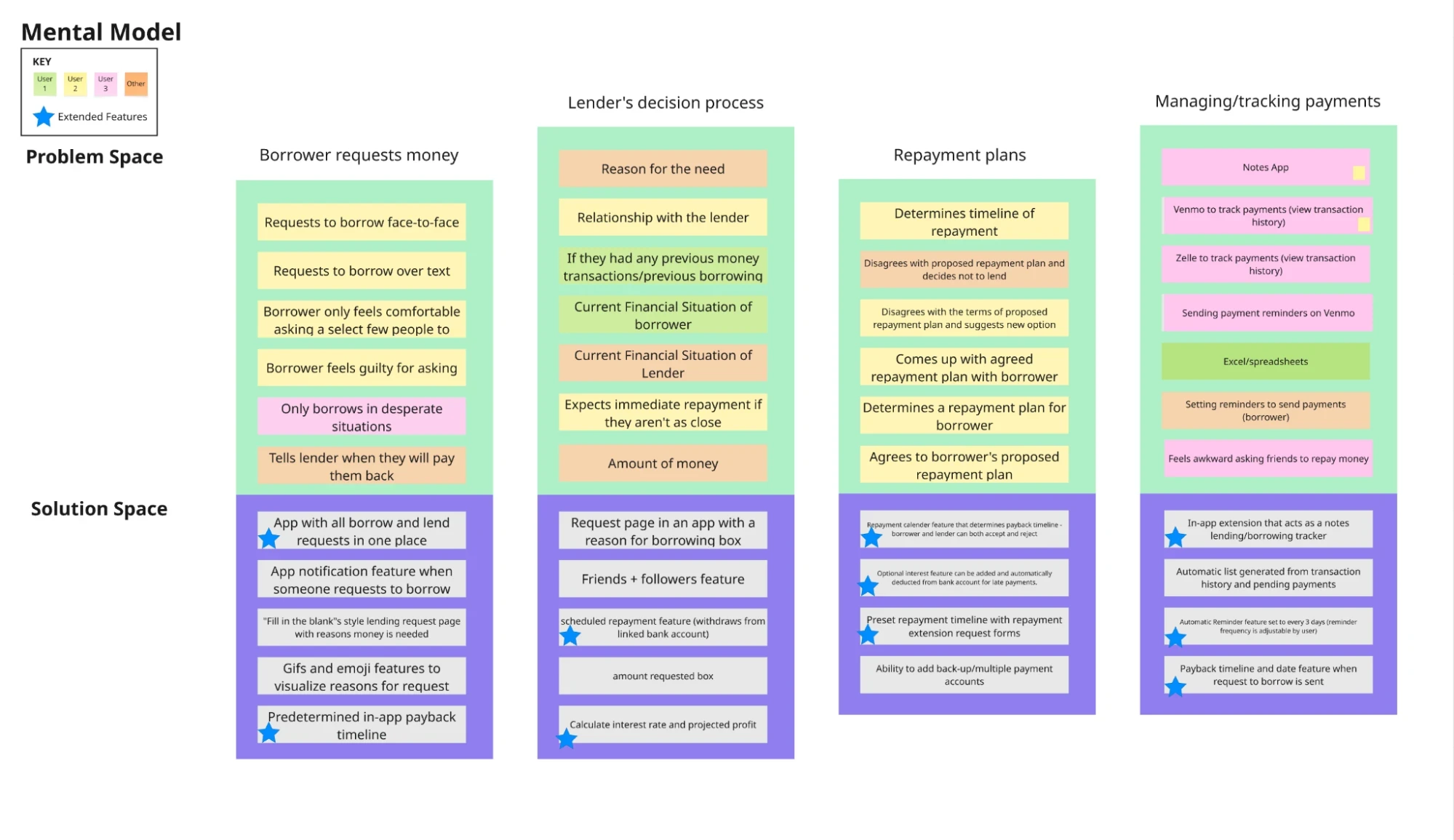

We constructed a mental model of the lending and borrowing experience in close-knit communities. It breaks the process into four key stages: how borrowers request money, how lenders make decisions, how repayment plans are set, and how payments are tracked.

Our Investigative Approach:

Interviews & Contextual Observation: We conducted three 20-30 minute interviews with potential users to explore how people in close-knit communities lend and borrow money. We designed an interview protocol to facilitate a conversation around the participant’s lived experiences and ideas.

Desk Research: We reviewed a variety of studies on informal lending and its related technologies.

Key Findings that Redefined the Problem:

Asking for money often leaves people feeling awkward or guilty.

Users currently rely on memory, notes apps, spreadsheets, and scattered text messages to keep track of their informal loans.

So we asked…

How might we reduce emotional and organizational friction in casual lending and borrowing?

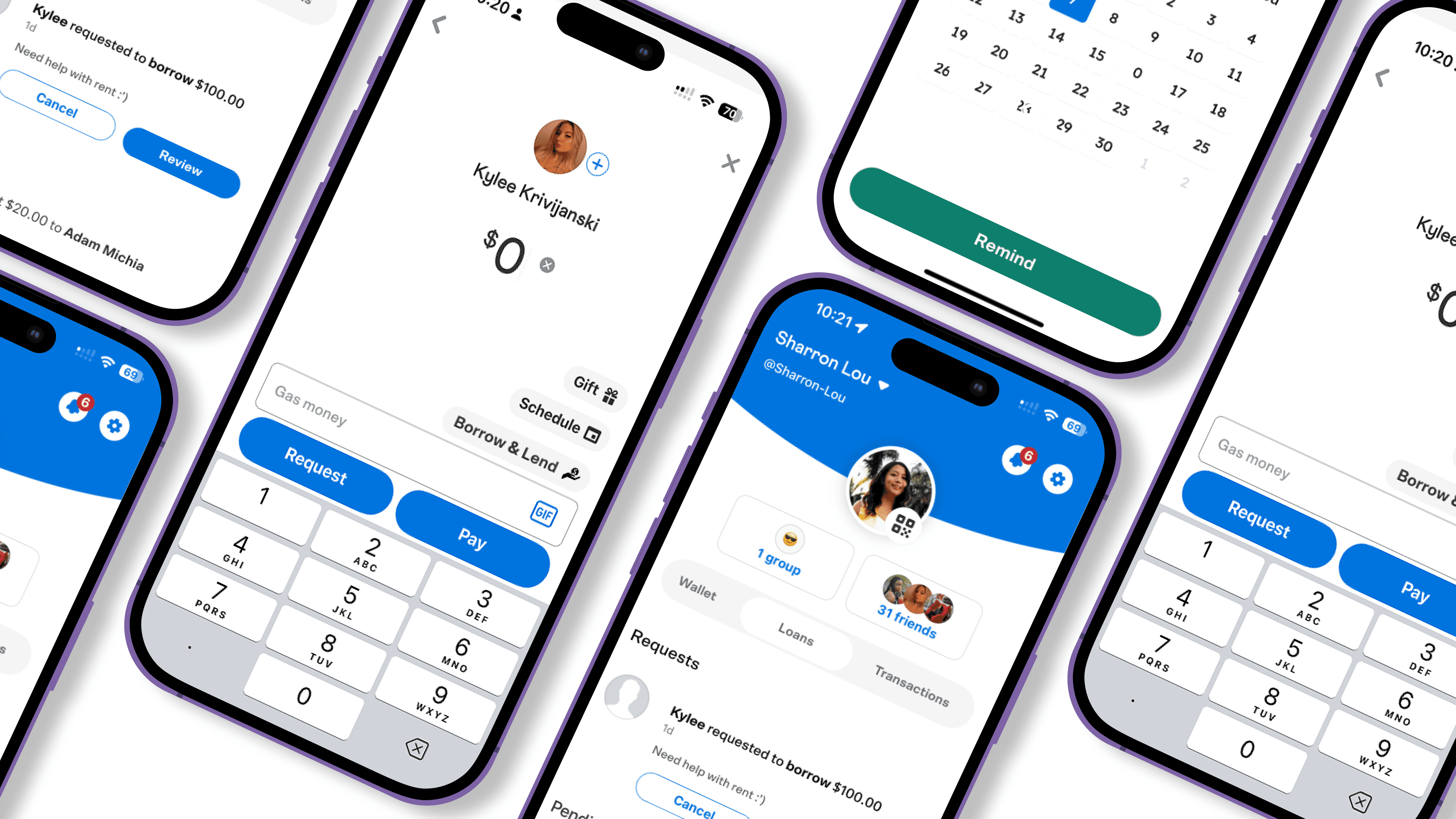

Solution

Designing for Empathy and Organization

Design Development:

Based on our research, we determined three key areas in the app for improvement.

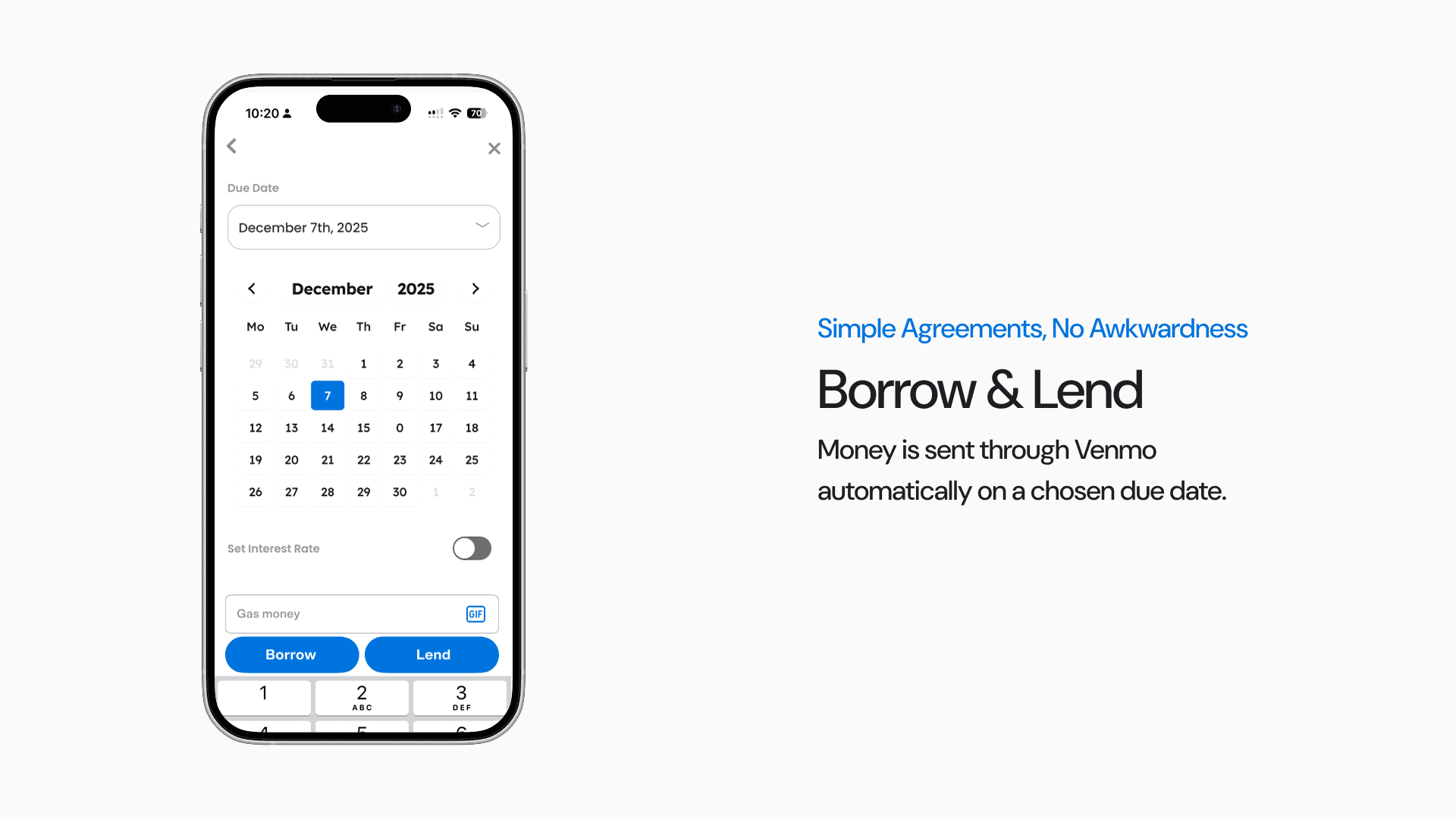

IOU agreement system: Creates a simple, shared record of the loan so no one feels awkward or unsure about what was agreed on.

Automatic payment system: Makes paying someone back straightforward, cutting down on the stress that comes with forgotten repayments.

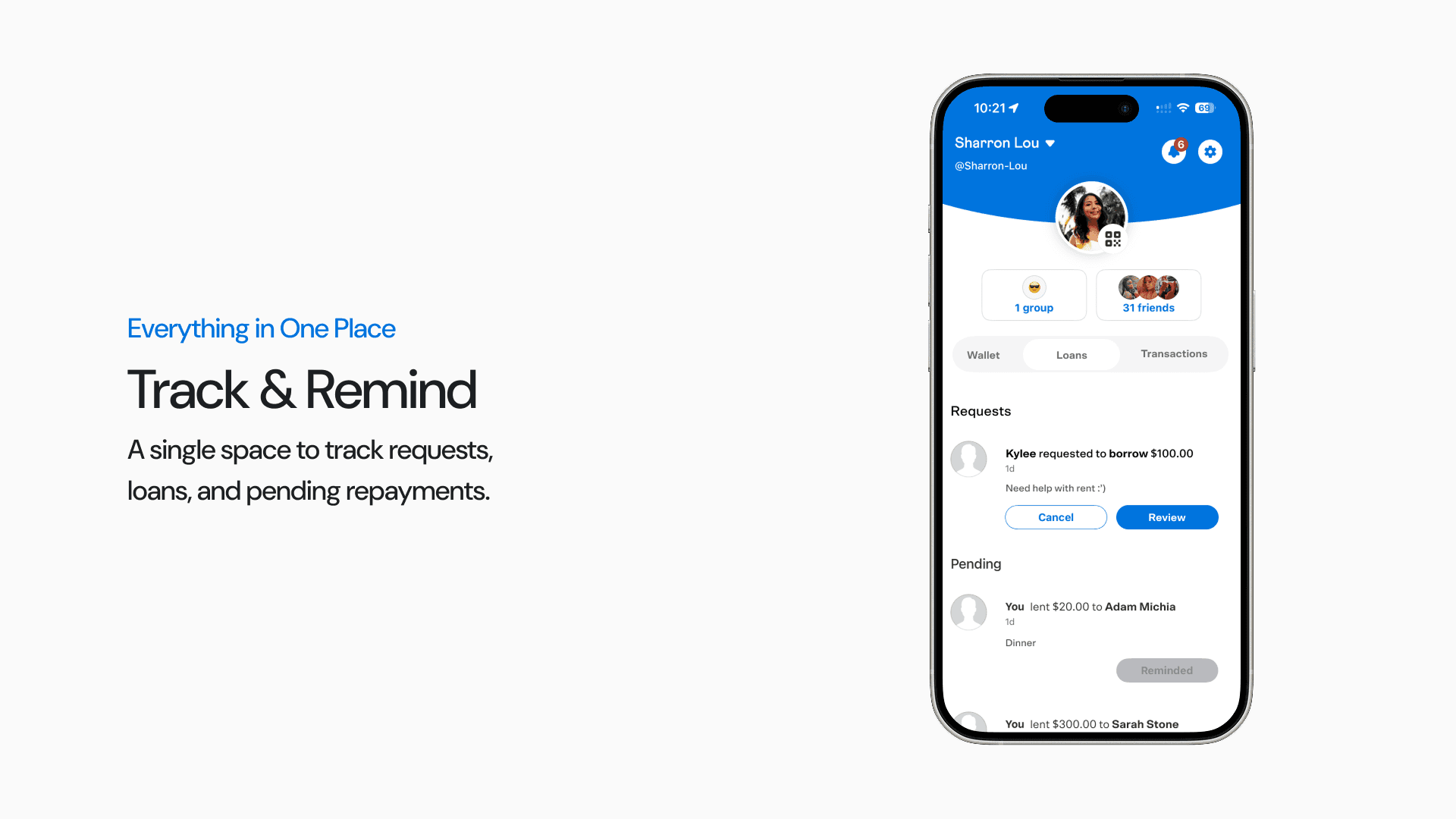

Reminder system: Gives friendly, low-pressure nudges that take the emotional weight off both lender and borrower.

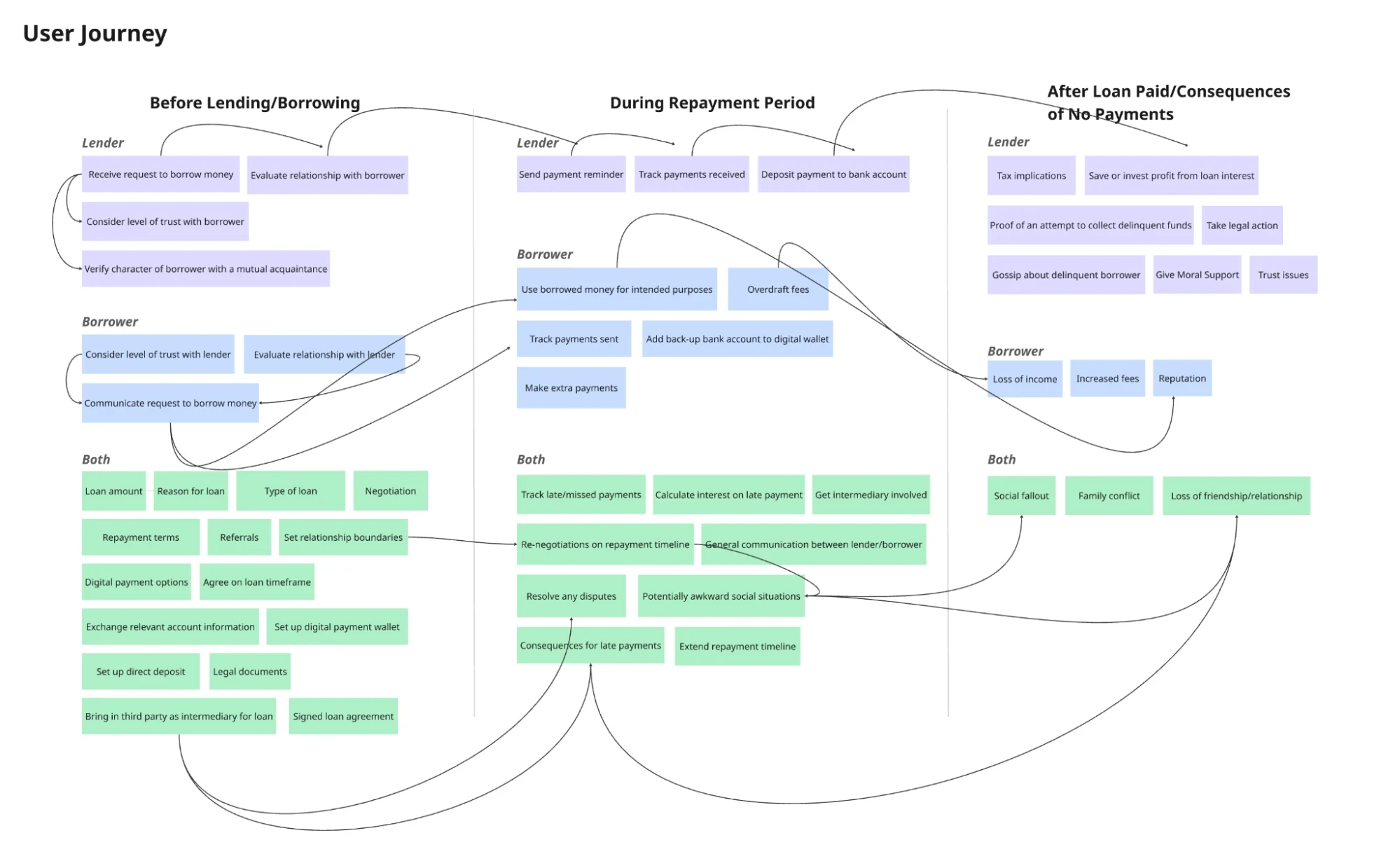

We built out a user journey map to better understand the flow of interactions within an informal lending/borrowing scenario, dividing it into three stages: Before Lending/Borrowing, During Repayment Period, and After Loan Paid/Consequences of No Payments. The black lines track potential user flows across the journey.

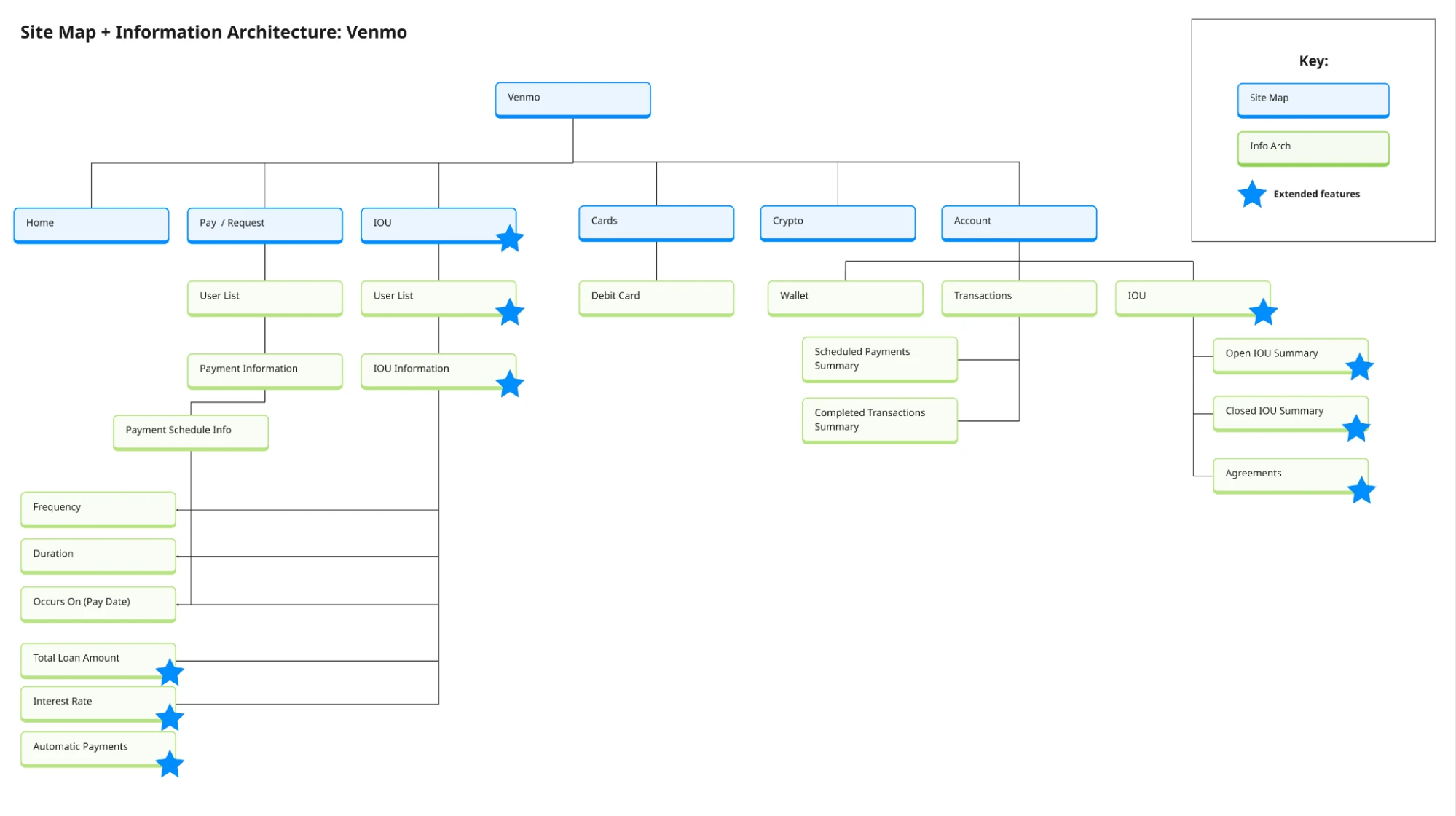

To map where we would build extensions of Venmo’s existing infrastructure, we built out a sitemap with information architecture outlining our areas of focus and design concepts.

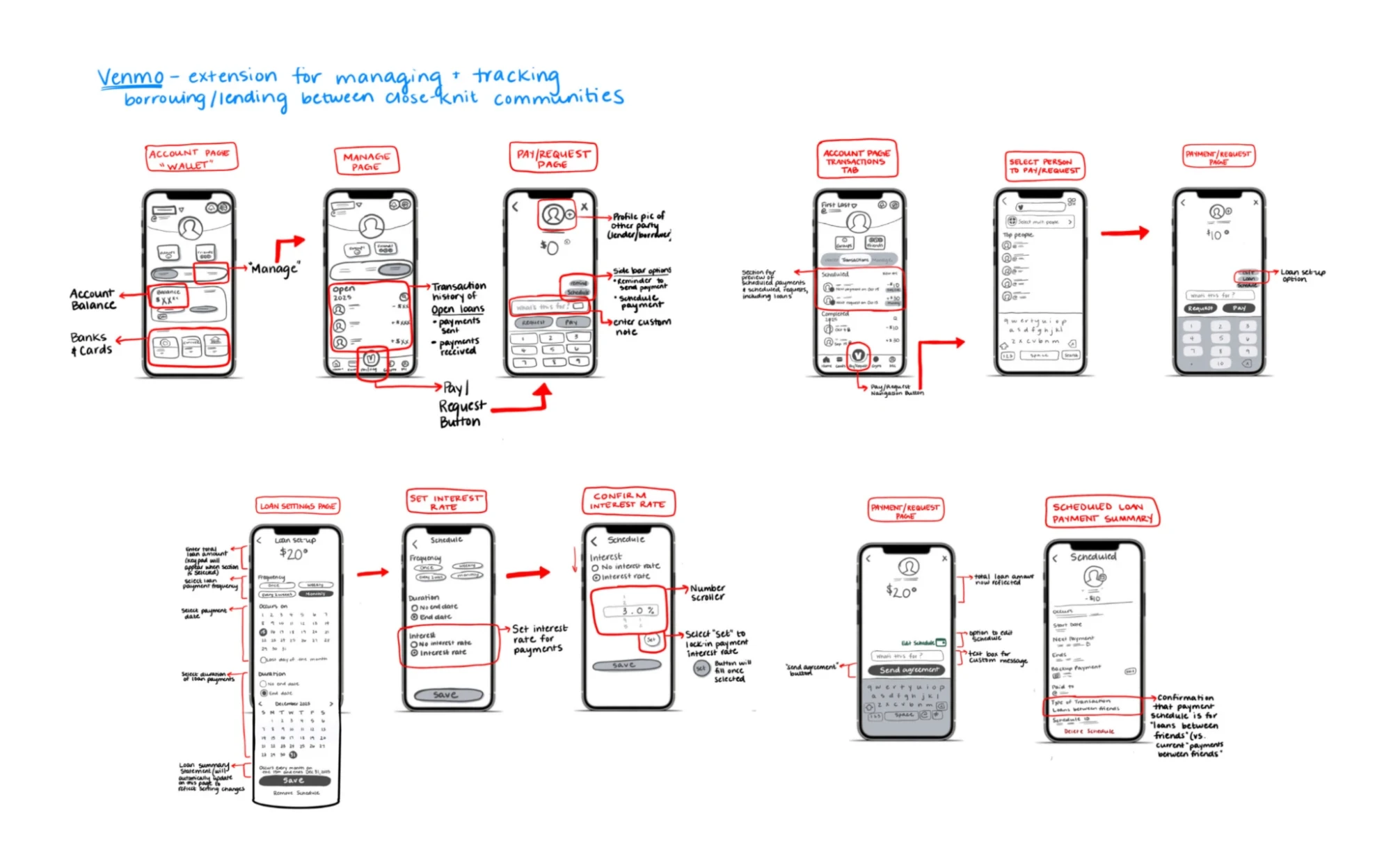

Then, we moved onto wireframing.

Designing for Accessibility

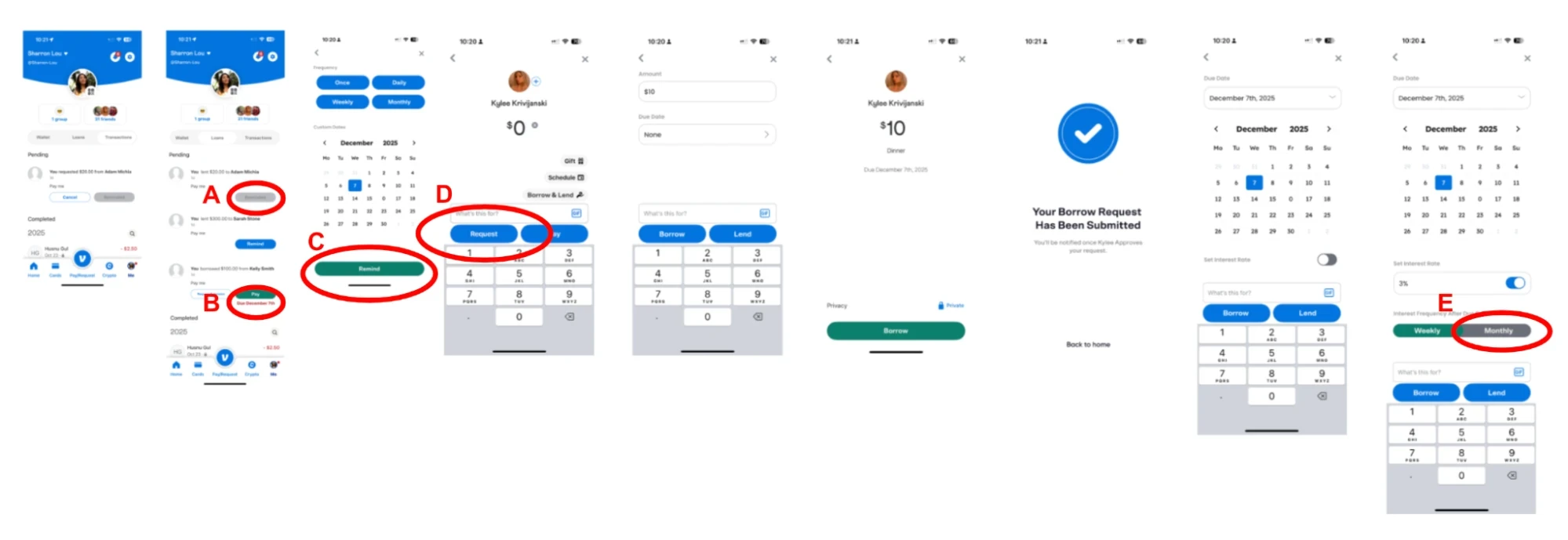

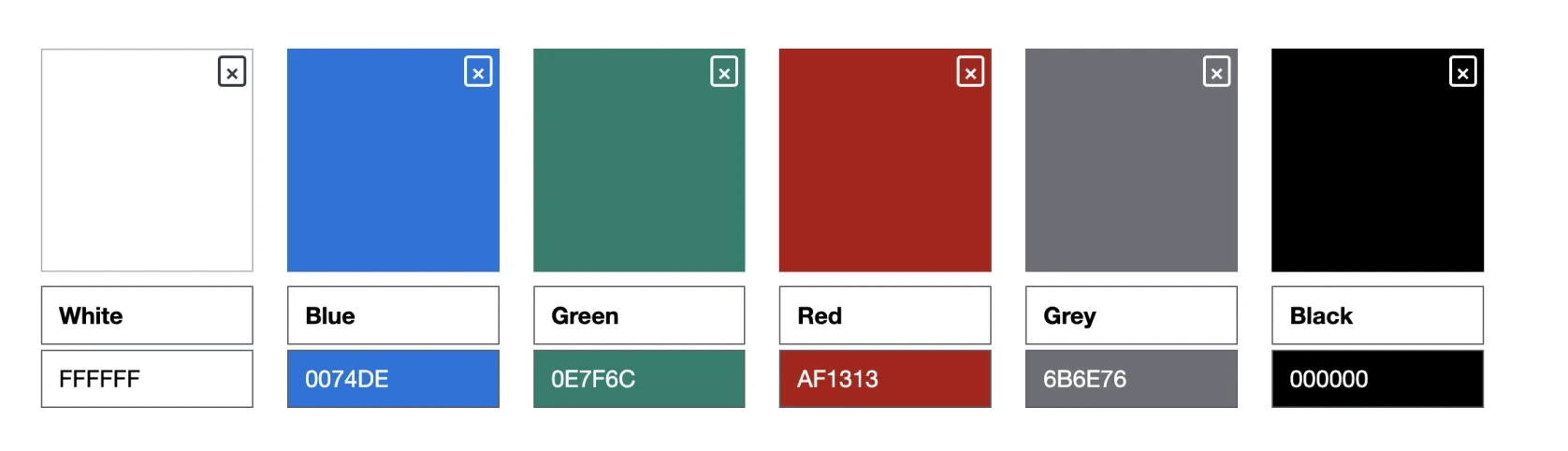

We tested Venmo’s existing color palette to ensure accessible readability using a combination of Figma’s accessibility testing functions and the Tanagru contrast checker. The "reminded" button did not meet accessibility standards, however this button’s color combination is an existing feature in Venmo.

High-fidelity wireframes with the testing elements circled in red.

Following our color contrast accessibility testing, we incorporated the following color palette into our final prototype iterations. It largely follows Venmo’s existing palette, but we updated our shade of grey used so that the “Reminded” button meets W3C’s Accessibility Guidelines contrast ratio minimum of at least 4.5.

Final Thoughts

With just a couple of weeks from prompt to presentation, we were only able to scratch the surface of possibilities. I identified areas that deserve deeper exploration to make our solution more reliable.

Consent Controls: Since borrow requests are fulfilled automatically, I'd explore giving users more control over approvals. This could include options to opt in/out of automatic processing.

Privacy and Data Transparency: Automatic transactions raise questions about privacy. Future iterations could focus on how personal financial data is displayed and shared between users.